How to Trade Breakouts and Avoid Fakeouts

Trading breakouts is exciting and can be very profitable. But, not all breakouts lead to lasting price changes. Many traders fall into the trap of false breakouts, or “fakeouts.” This guide will teach you how to trade breakouts well and avoid fakeouts.

What is a Breakout in Trading?

A breakout happens when the price goes beyond a support or resistance level with more volume. This shows a possible trend change or continuation. Breakouts can happen in stocks, forex, commodities, and cryptocurrencies, making them a great strategy for day traders.

Types of Breakouts

| Type | Description | Example |

|---|---|---|

| Trend Breakout | Occurs when price breaks a strong trendline | A stock in an uptrend breaking above resistance |

| Range Breakout | Price moves outside a consolidation phase | A currency pair moving beyond a sideways range |

| Chart Pattern Breakout | Breaks from patterns like triangles, flags, or head & shoulders | A stock breaking out of a bullish flag pattern |

| News-Based Breakout | Price surges due to fundamental news | A company’s stock spiking after strong earnings |

How to Identify a Strong Breakout

High Trading Volume:

A true breakout should have higher-than-average volume.

Low volume breakouts often indicate fakeouts.

Retest of the Breakout Level:

A strong breakout often retests the previous resistance (now support) before continuing.

Momentum Indicators Confirmation:

Use RSI, MACD, or Stochastic Oscillator to confirm strength.

Candlestick Patterns:

Strong bullish candles indicate a genuine breakout.

Weak wicks and indecision candles suggest a possible fakeout.

How to Trade Breakouts Effectively

1. Wait for Confirmation

Enter the trade only after a retest or strong follow-through candle.

Avoid jumping in too early as initial moves can be deceptive.

2. Use Stop-Loss Orders

Set stop-loss slightly below the breakout level to protect against fakeouts.

Adjust stop-loss as the trade progresses.

3. Trade with Volume Support

High volume increases the chance of a breakout sustaining momentum.

4. Monitor Key Resistance & Support Levels

Use moving averages, Fibonacci retracements, and trendlines to identify significant levels.

5. Combine Indicators for Better Accuracy

RSI above 50 and MACD bullish crossover confirm a breakout.

Bollinger Bands widening indicate higher volatility.

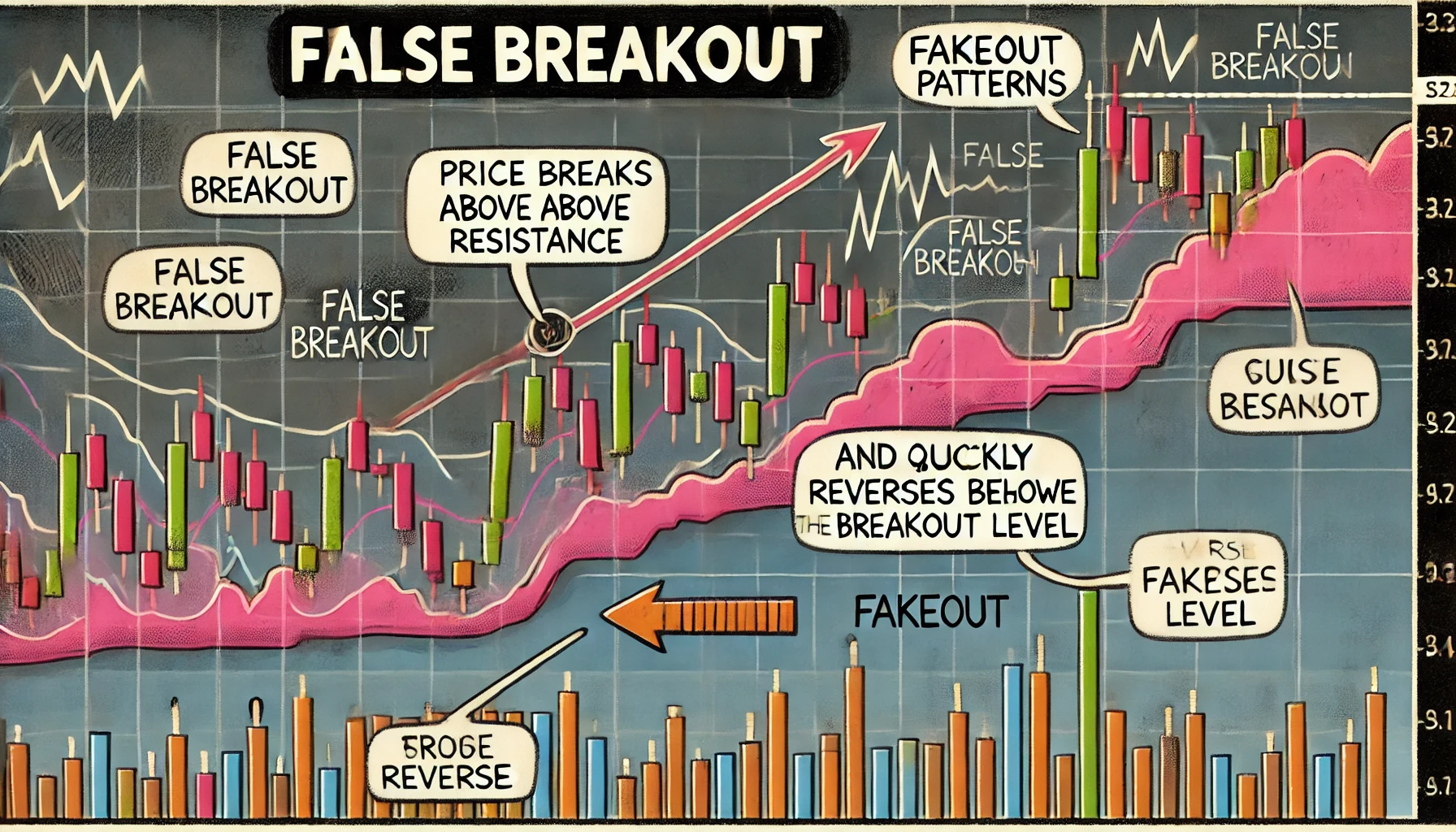

How to Avoid Fakeouts

1. Fakeout Warning Signs

Low Volume: A breakout without a surge in volume is suspicious.

Quick Reversal: If price quickly falls back inside the range, it’s a fakeout.

Indecision Candlesticks: Doji and spinning tops suggest market hesitation.

2. Watch for Stop-Hunting Moves

Market makers often push price beyond key levels to trigger stop-losses before the real move.

3. Enter on Retests, Not Initial Moves

Breakouts that retest previous levels are more reliable.

4. Use Multiple Timeframes

A breakout on a 5-minute chart might be noise, but confirmation on a 1-hour chart strengthens reliability.

Example of a Breakout Trade Strategy

Identify a strong resistance level at $50 on a stock.

Wait for a price breakout above $50 with a surge in volume.

Confirm with RSI above 60 and MACD crossover.

Enter the trade at $51 after a retest of $50.

Place stop-loss at $49.80 to limit risk.

Take profit at $55 for a 2:1 risk-reward ratio.

Breakout Trading Mistakes to Avoid

Chasing the Move: Entering too late can lead to poor risk-reward setups.

Ignoring Volume: Always check if the breakout is supported by volume.

No Stop-Loss: Always have a risk-management plan.

Not Considering Market Sentiment: News and overall market trends affect breakouts.

Final Thoughts

Breakout trading is powerful but needs patience, discipline, and confirmation to avoid fakeouts. Use volume analysis, wait for retests, and combine technical indicators to boost success in breakout trades.

FAQs

1. What is the best indicator for breakout trading?

Volume is key, followed by RSI and MACD for confirmation.

2. How do I differentiate a real breakout from a fakeout?

Look for high volume, strong follow-through candles, and retests.

3. Should I trade breakouts on all timeframes?

Higher timeframes offer more reliable breakouts, while lower timeframes may have more fakeouts.

4. Can I trade breakouts in forex and crypto?

Yes, breakout strategies work in all markets, including stocks, forex, and cryptocurrencies.

5. What is the best stop-loss strategy for breakout trading?

Set stop-loss slightly below the breakout level to avoid being stopped out by minor fluctuations.

Mastering breakout trading techniques and avoiding common pitfalls can help traders capitalize on high-probability setups. This enhances their day trading performance.