Understanding Algo Trading: How Bots Are Changing the Market

Algorithmic trading, or algo trading, has changed financial markets a lot. It uses automated strategies to make trades fast. Artificial intelligence and machine learning have made algo trading bots key for both big and small traders. But, how do these bots work, and what’s their effect on markets?

What is Algorithmic Trading?

Algorithmic trading uses computer programs to make trades based on set rules. These programs look at market conditions, find good times to trade, and act faster than humans.

How Algo Trading Works

Market Data Analysis: The algorithm checks price charts, news, and economic data.

Strategy Execution: The bot makes buy and sell orders based on set rules.

Risk Management: It uses stop-loss and take-profit to protect against losses.

Order Placement: The bot makes trades at the best prices using high-frequency trading.

Types of Algorithmic Trading Strategies

| Strategy | Description | Example |

|---|---|---|

| Trend Following | Bots buy when prices rise and sell when they fall. | Moving average crossover strategy |

| Mean Reversion | Prices will return to the mean over time. | Bollinger Bands-based trading |

| Arbitrage | Uses price differences between markets. | Buying Bitcoin cheaper and selling it higher |

| Market Making | Places orders to provide liquidity. | High-frequency trading on stocks |

| News-Based Trading | Bots react to news that moves markets. | AI-based sentiment analysis of news |

Benefits of Algo Trading

Speed & Efficiency – Bots make trades in milliseconds.

Reduced Emotional Bias – No human emotions in trading decisions.

Backtesting Capability – Test strategies on past data.

Better Risk Management – Automated stop-losses and portfolio balancing.

24/7 Trading – Great for crypto markets.

Challenges & Risks of Algo Trading

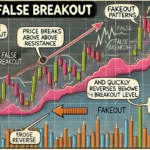

Market Manipulation Risks – Flash crashes and spoofing tactics.

Over-Reliance on Technology – System failures can cause big losses.

High Competition – Big bots make it tough for small traders.

Regulatory Scrutiny – More rules due to unfair trading advantages.

How Algo Trading is Changing Financial Markets

Increased Liquidity: Bots help prices move smoothly.

Lower Trading Costs: Less need for manual traders.

Greater Market Volatility: Fast trading can cause flash crashes.

Improved Efficiency: More accurate price discovery and execution.

How to Get Started with Algo Trading

Choose a Platform – Popular ones include MetaTrader, NinjaTrader, and QuantConnect.

Learn a Programming Language – Python, C++, and Java are common choices.

Develop a Strategy – Backtest before live trading.

Use Risk Management – Set stop-loss and position sizing rules.

Monitor Performance – Regularly optimize and adjust your bot.

FAQs

1. Is algorithmic trading profitable?

Yes, if strategies are well-designed and markets are efficiently analyzed.

2. Can beginners use algo trading?

Yes, but it requires some coding and market knowledge.

3. Are algo trading bots legal?

Yes, but some high-frequency trading tactics are regulated.

4. What markets use algo trading?

Stocks, forex, crypto, and commodities markets.

5. What is the best algo trading strategy?

It depends on market conditions, but trend following and arbitrage are popular.

Algorithmic trading is changing the financial world. It offers new chances and challenges for traders. Whether you’re new or experienced, knowing about trading bots can help you succeed in today’s markets.