How Global Events Impact Stock Prices and How to React

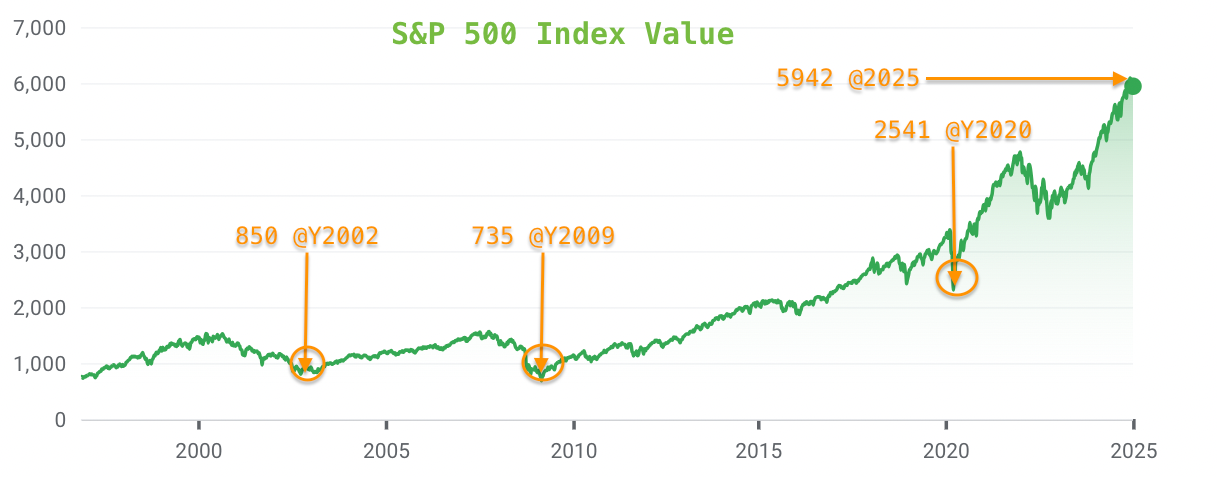

In today’s world, global events like wars and economic changes can really affect stock markets. It’s key for investors to understand these effects and know how to react. This helps protect and grow their investments.

1. The Ripple Effect of Global Events on Stock Markets

Global events often start big reactions in stock markets. These events can be divided into a few main types:

Geopolitical Tensions: Conflicts or diplomatic issues can make markets uncertain. For example, peace talks between India and Pakistan boosted their stock markets. This shows how peace can increase investor confidence .

Economic Policies: Decisions like tariffs or interest rate changes can have big effects. The 2025 U.S. tariff hikes, called “Liberation Day,” caused a big drop in global markets .

Natural Disasters and Pandemics: Events like the COVID-19 pandemic can disrupt economies and cause market ups and downs.

2. Case Study: The 2025 Stock Market Crash

In April 2025, global stock markets fell sharply after the U.S. announced big tariffs. This move, aimed at protecting domestic industries, led to:

Investor Panic: Investors quickly sold off stocks, fearing the impact of trade barriers.

Global Impact: Markets around the world, including Europe and Asia, felt the effects. This shows how today’s economies are connected.

Temporary Recovery: A 90-day tariff truce between the U.S. and China gave short-term relief. But long-term worries remained .

3. Understanding Market Sentiment

Market sentiment is the overall feeling of investors toward a market or asset. It’s shaped by:

News and Media: News on the economy, company earnings, or global events can change how investors feel.

Psychological Factors: Feelings like fear or greed can drive market movements. These feelings can lead to irrational choices.

External Events: Non-economic events, like natural disasters or big political changes, can also affect sentiment .

4. Strategies to Navigate Market Volatility

Investors can use several strategies to handle market risks:

Diversification: Investing in different sectors and places can lower risk.

Stay Informed: Keeping up with news and economic data helps make quick decisions.

Long-Term Perspective: While short-term reactions can be harsh, a long-term view often leads to better results.

Consult Financial Advisors: Experts can give advice based on your risk level and goals.

5. The Role of Economic Indicators

Key economic indicators give clues about market directions:

Inflation Rates: Rising inflation can reduce buying power, leading to market adjustments.

Employment Data: Job trends often show economic health, influencing investor choices.

Interest Rates: Central bank policies on interest rates can change borrowing costs and returns.

In May 2025, softer U.S. inflation data made investors more willing to take risks. This boosted stock futures and commodities .

6. The Importance of Global Diversification

Investing beyond your home country can offer:

Growth Opportunities: New markets or areas with economic changes can give you higher returns.

Risk Mitigation: Markets around the world can react differently to big events. This can balance your investment’s performance.

In 2025, while U.S. markets saw downturns, European and Latin American markets rallied. This shows the value of spreading your investments globally.

7. Leveraging Technology and Tools

Today, investors have many tools to stay ahead:

Real-Time News Platforms: Services like Reuters and Bloomberg give you updates on global news fast.

Financial Apps: Apps let you track your portfolio, get market analysis, and receive alerts.

Educational Resources: Online courses and webinars can improve your investment knowledge and strategy.

8. Conclusion

Global events surely affect stock markets, causing ups and downs. But, by understanding these effects and using smart strategies, investors can overcome challenges and find opportunities. It’s important to stay informed, diversify, and keep a long-term view to be financially strong in a changing world.