In 2025, the stock market is shaped by many factors. These include new technologies and changes in world politics. Experts share their views on what investors should look out for in the next months. This article explores these predictions, focusing on key trends and areas expected to grow.

1. Economic Outlook and Market Sentiment

The global economy in 2025 is cautiously optimistic. Central banks, like the Federal Reserve, have cut interest rates to boost growth. Yet, global tensions, like the Russia-Ukraine conflict and U.S.-China trade issues, add uncertainty. Investors should stay updated and flexible, considering both economic signs and world events.

2. Technology Sector: The AI Revolution

Artificial Intelligence (AI) is leading the tech sector. Companies are using AI to improve efficiency and create new products. Nasdaq says AI will help companies’ profits by making work more productive. Investors are watching AI companies for growth chances.

3. Healthcare Sector: Embracing Innovation

The healthcare field is changing fast, thanks to new tech and a need for personalized care. McKinsey forecasts healthcare profits will grow 7% annually from 2022 to 2027. Advances in telemedicine, biotech, and health tech are driving this growth, making healthcare a key sector in 2025.

4. Energy Sector: Transitioning to Renewables

The energy sector is shifting, balancing old fuels with new ones. The move to renewable energy is speeding up, thanks to green concerns and tech progress. Solar and wind are getting cheaper, and battery tech is improving fast. Companies focused on renewables are likely to keep doing well.

5. Global Markets: Diversification Beyond U.S. Borders

Investors are looking beyond the U.S. for growth. Markets in Europe, Asia, and Latin America are promising, with places like Germany and Brazil doing well. Good currency moves and big spending plans are helping. Adding international stocks to your portfolio can tap into these markets.

6. Investment Strategies: Navigating Uncertainty

Investors are using smarter strategies in a changing world. More people are considering Environmental, Social, and Governance (ESG) factors in their choices. By 2025, ESG will be a big part of most investors’ decisions. Also, focusing on value stocks and sectors with solid foundations can help in uncertain times.

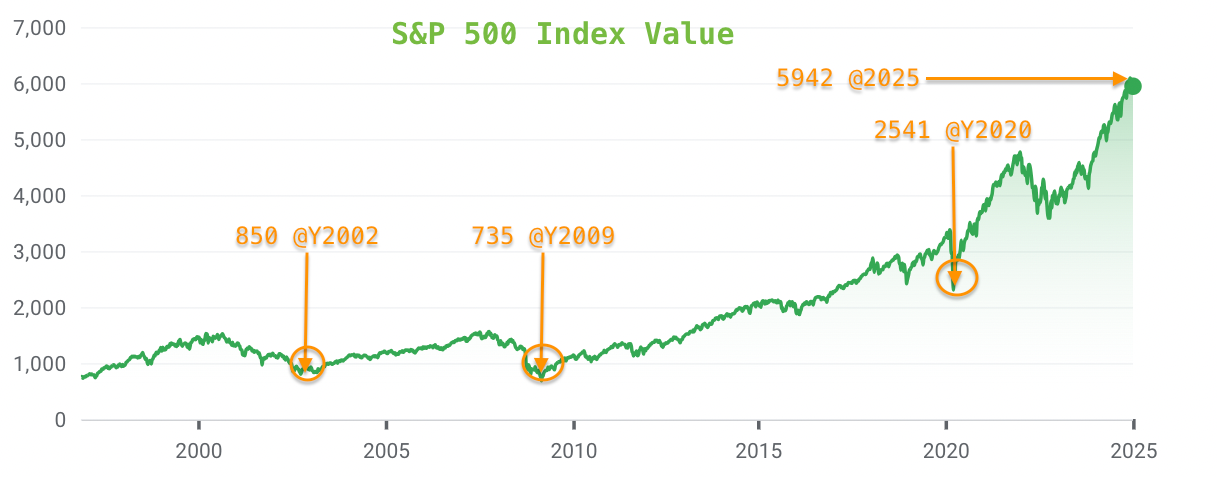

7. Expert Forecasts: S&P 500 and Beyond

Financial groups have given different views on the S&P 500:

Goldman Sachs has upped its six-month S&P 500 target to 6,100, thanks to lower tariffs and stronger growth.

JPMorgan Chase sees the S&P 500 hitting 6,500 by 2025, thanks to AI and better global policies.

Morgan Stanley is hopeful, aiming for 6,500 as a base case, with a bull case of 7,400.

These forecasts highlight the need to stay informed and flexible in investing.

8. FAQs

Q1: What sectors are expected to perform well in 2025?

A: Technology, healthcare, and renewable energy are set to grow a lot. This is because of new ideas and more demand.

Q2: How should investors approach the current market volatility?

A: Spread out your investments, look for value stocks, and keep up with world news. This helps with market ups and downs.

Q3: What impact does AI have on the stock market?

A: AI makes things more efficient in many fields. This could lead to more growth for companies using AI well.

Q4: Are international markets a good investment in 2025?

A: Yes, markets in Europe, Asia, and Latin America are doing well. They offer a chance to diversify your investments.

Q5: How important is ESG investing in 2025?

A: ESG investing is now common. More investors are looking at how companies treat the environment, society, and governance.

Q6: What are the risks associated with investing in 2025?

A: There are risks like global tensions, inflation, and fast tech changes. It’s key to stay updated and flexible.

Conclusion

The stock market in 2025 is full of chances and challenges. By looking at new trends, spreading out investments, and keeping up with global news, you can do well. Always talk to a financial advisor and do your homework before investing.

Note: The information in this article is for general knowledge only. It’s not financial advice. Always talk to a financial advisor before investing.