Introduction

Healthcare costs keep going up, making long-term care insurance (LTCI) a key financial safety net for many Americans. With more people living longer, planning for future care needs is now more critical than ever.

In this guide, we’ll cover:

✔ What is long-term care insurance?

✔ Average costs in 2025

✔ Key benefits and coverage options

✔ Best long-term care insurance companies

✔ Alternatives to traditional LTCI

Whether you’re in your 50s, 60s, or older, learning about LTCI can help you protect your savings. It ensures quality care in your later years.

What Is Long-Term Care Insurance?

Long-term care insurance covers costs for extended medical and personal care services. This includes:

Nursing home care

Assisted living facilities

In-home care (skilled nursing, therapy, custodial care)

Adult day care services

LTCI is different from regular health insurance or Medicare. It’s made for chronic illnesses, disabilities, or age-related conditions needing ongoing help with daily activities (ADLs) like bathing, dressing, and eating.

Why Is LTCI Important in 2025?

Rising healthcare costs: A private nursing home room costs over $100,000/year in many places.

Medicare limitations: Medicare only pays for short-term skilled nursing care, not long-term custodial care.

Aging population: By 2030, all Baby Boomers will be 65+, increasing the need for care services.

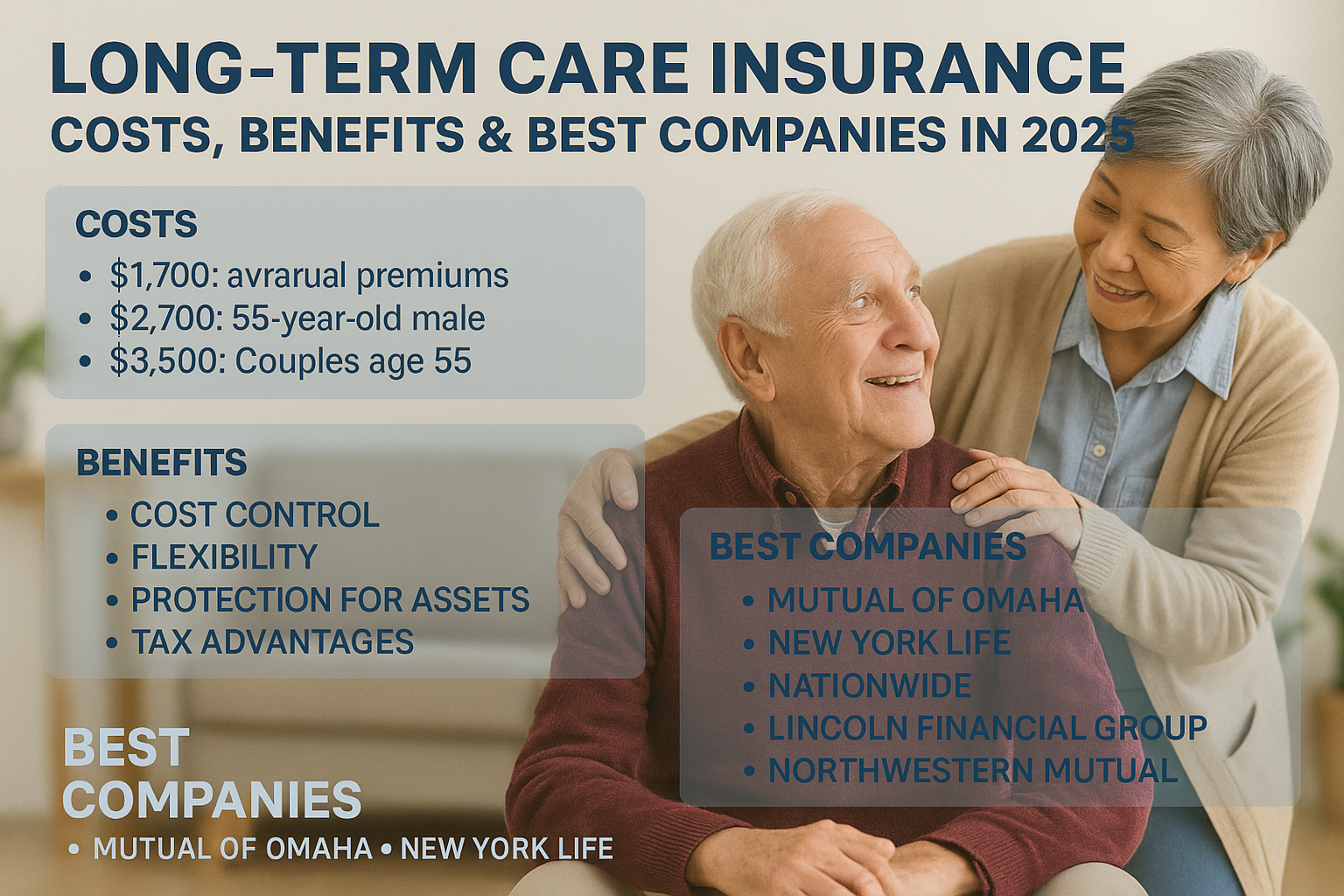

Long-Term Care Insurance Costs in 2025

LTCI prices vary based on several factors, including:

✅ Age at enrollment (cheaper if bought younger)

✅ Health status (pre-existing conditions may raise premiums)

✅ Coverage amount & duration

✅ Inflation protection (optional but recommended)

Average Annual Premiums (2025 Estimates)

| Age at Purchase | Annual Premium (Approx.) |

|---|---|

| 55 years old | 2,500–2,500–3,500 |

| 60 years old | 3,000–3,000–4,500 |

| 65 years old | 4,000–4,000–6,000 |

| 70 years old | 6,000–6,000–8,500+ |

Sample Cost of Care Without Insurance (2025 Projections)

| Type of Care | Annual Cost (Approx.) |

|---|---|

| Nursing Home (Private) | 120,000–120,000–150,000 |

| Assisted Living | 60,000–60,000–90,000 |

| In-Home Care (44 hrs/week) | 70,000–70,000–100,000 |

Without insurance, these costs can quickly drain your retirement savings.

Key Benefits of Long-Term Care Insurance

Financial Security – Protects retirement funds from high care costs.

Flexible Care Options – Covers in-home care, assisted living, and nursing homes.

Reduces Family Burden – Prevents relatives from becoming unpaid caregivers.

Tax Advantages – Some policies qualify for tax deductions (check IRS guidelines).

Inflation Protection – Optional riders adjust benefits to keep up with rising costs.

What Does LTCI Typically Cover?

Nursing home stays

Assisted living facilities

Home health aides

Physical & occupational therapy

Hospice care

Respite care for family caregivers

Note: Most policies have an elimination period (e.g., 30-90 days) before benefits kick in.

Best Long-Term Care Insurance Companies in 2025

Choosing the right provider is critical. Here are the top-rated LTCI companies based on financial strength, customer service, and policy options:

1. New York Life

Rating: A++ (AM Best)

Pros: Strong financial stability, hybrid life/LTC options

Cons: Higher premiums

2. Mutual of Omaha

Rating: A+ (AM Best)

Pros: Customizable plans, good customer reviews

Cons: Limited discounts

3. Northwestern Mutual

Rating: A++ (AM Best)

Pros: Excellent claims history, dividend-paying policies

Cons: Requires medical underwriting

4. Genworth

Rating: B++ (AM Best)

Pros: Long-standing LTCI provider, multiple coverage options

Cons: Recent financial struggles

5. Thrivent (Lutheran Brotherhood)

Rating: A+ (AM Best)

Pros: Faith-based, strong member benefits

Cons: Limited availability

6. State Farm

Rating: A++ (AM Best)

Pros: Bundling discounts, trusted brand

Cons: Fewer standalone LTC policies

7. Nationwide (Hybrid Policies)

Rating: A+ (AM Best)

Pros: Life insurance with LTC riders

Cons: Complex underwriting

Alternatives to Traditional Long-Term Care Insurance

If standalone LTCI is too expensive, consider:

1. Hybrid Life Insurance with LTC Riders

Combines life insurance with long-term care benefits.

If unused, beneficiaries receive a death benefit.

2. Annuities with LTC Features

Provides income with added long-term care coverage.

3. Health Savings Accounts (HSAs)

Tax-advantaged savings for medical expenses, including LTC.

4. Self-Insurance (Savings & Investments)

Requires significant assets but avoids premium costs.

How to Choose the Best Policy in 2025

Start Early – Premiums are lower in your 50s or early 60s.

Compare Multiple Quotes – Use an independent insurance broker.

Check Financial Ratings – Look for A-rated insurers.

Understand Policy Terms – Elimination period, benefit period, inflation protection.

Consider Hybrid Policies – Good for those wanting flexibility.

Final Thoughts

Long-term care insurance is a smart investment for protecting your financial future. With costs of care skyrocketing, securing a policy before health issues arise can save you and your family from significant financial strain.

Key Takeaways:

✔ LTCI covers nursing homes, assisted living, and in-home care.

✔ Premiums rise with age—buying early locks in lower rates.

✔ Top providers include New York Life, Mutual of Omaha, and Northwestern Mutual.

✔ Hybrid policies offer life insurance + LTC benefits.

Planning ahead ensures you receive quality care without sacrificing your life savings. Get a free quote today to explore your options!