Stablecoins in Focus: Why They’re Shaking Up the Financial System

Meta Description: Stablecoins in Focus: Why They’re Shaking Up the Financial System—exploring how these digital currencies are transforming finance by blending the best of crypto and traditional money.

Introduction

Imagine sending money to a friend in another country and having it arrive in seconds—not days—with barely any fees. Or picture being able to save your earnings without worrying about inflation or volatile exchange rates. Sounds futuristic? It’s not. It’s already happening, thanks to stablecoins.

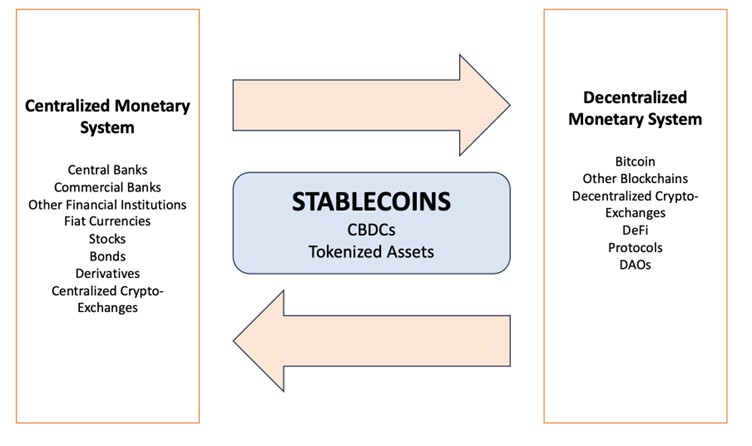

In the ever-evolving world of digital finance, stablecoins have emerged as a powerful force. These digital assets, designed to maintain a steady value, are quietly rewriting the rules of money. Unlike their more volatile crypto cousins like Bitcoin and Ethereum, stablecoins offer a predictable, secure, and fast way to transact—anywhere, anytime.

Now, let’s dive deep into why stablecoins are more than just a financial trend—they’re a full-blown revolution.

What Are Stablecoins?

At their core, stablecoins are cryptocurrencies. But unlike Bitcoin, which can jump or drop in value overnight, stablecoins are pegged to stable assets like the U.S. dollar, euro, or even gold. This pegging ensures their value remains consistent.

There are three main types:

Fiat-Backed Stablecoins – These are backed 1:1 by cash or equivalents. Think of each stablecoin being matched by a real dollar in a bank account.

Crypto-Backed Stablecoins – These use other cryptocurrencies as collateral. They’re decentralized but over-collateralized to manage price swings.

Algorithmic Stablecoins – These aren’t backed by anything physical. Instead, they rely on smart contracts and algorithms to manage supply and demand.

Each has its strengths and weaknesses, but all aim to provide one thing: price stability in the digital world.

Why Stablecoins Are Making Waves in Finance

So, what’s the big deal about stablecoins? Why is Wall Street watching them, and why are governments drafting entire bills around them?

Here’s why:

1. They Bring Stability to Crypto

Crypto is notorious for its rollercoaster prices. Stablecoins tame that wild ride, making digital transactions safe and predictable.

2. They Power DeFi (Decentralized Finance)

Stablecoins are the backbone of decentralized finance. People use them to lend, borrow, and earn interest without banks. That means financial freedom without intermediaries.

3. They’re Perfect for Global Payments

International money transfers can be slow and expensive. Stablecoins eliminate those issues. Send money globally in seconds—no banks, no borders, minimal fees.

4. They’re Shaping Monetary Policy

Governments are taking notice. As more money flows into stablecoins, they’re becoming influential players in global finance. Some believe they could even rival national currencies in the future.

Everyday Benefits of Using Stablecoins

For regular folks—not just crypto pros—stablecoins open up exciting opportunities:

Savings without fear – No inflation wiping out your hard-earned money.

Fast payments – Split a dinner bill or pay a freelancer across the globe instantly.

Accessible to all – You only need a smartphone and internet. No credit history required.

Low transaction costs – Forget wire fees and ATM charges.

Secure and private – Transactions are encrypted and often anonymous.

It’s like having a digital dollar that works smarter, not harder.

Risks and Challenges of Stablecoins

Despite the hype, stablecoins come with caveats. Here are a few things to watch for:

| Risk | Why It Matters |

|---|---|

| De-Pegging | Some stablecoins have lost their value peg, especially algorithmic ones, causing massive losses. |

| Transparency Issues | Not all issuers show where the backing funds are kept or how they’re managed. |

| Regulatory Pressure | With growing popularity comes government scrutiny. Future regulations could impact accessibility. |

| Centralization | Fiat-backed stablecoins often rely on a single company or bank, which may undermine decentralization. |

Understanding these risks is essential for anyone entering the space.

How Governments Are Responding

Governments around the world are no longer sitting on the sidelines. They’re acting—fast.

The U.S. is crafting laws to ensure stablecoin issuers hold real reserves, conduct audits, and operate transparently.

Europe’s MiCA regulation mandates full disclosures and reserve backing for euro-based stablecoins.

Asian countries like Singapore and Japan are embracing innovation while building strong regulatory walls around digital currencies.

This growing oversight is a sign that stablecoins are entering the mainstream.

Real-World Use Cases for Stablecoins

Stablecoins aren’t just digital toys. They’re solving real problems:

Protecting savings in countries with hyperinflation.

Powering payroll for freelancers working across borders.

Facilitating cross-border business for import/export companies.

Enabling micro-loans and remittances in underserved regions.

Serving as reserves for decentralized protocols and blockchain banks.

They’re not just a tool for crypto enthusiasts. They’re transforming how businesses and individuals handle money.

What’s the Future of Stablecoins?

The stablecoin revolution is just getting started. Here’s what’s coming next:

Bank-issued stablecoins – Big banks may launch their own digital dollars.

More government oversight – Expect stricter but clearer regulations.

Greater adoption – E-commerce, salaries, and savings accounts could all integrate stablecoins.

Hybrid models – Combining private innovation with public trust, possibly blending CBDCs (central bank digital currencies) with stablecoins.

Stablecoins are set to become a core part of how we move money. They’re the missing link between today’s banking and tomorrow’s digital economy.

Frequently Asked Questions (FAQs)

Q1: What makes stablecoins different from Bitcoin?

Stablecoins maintain a fixed value by being backed by assets, while Bitcoin’s price can swing wildly.

Q2: Are stablecoins safe to use?

Yes—if they’re fully backed and transparent. Stick with trusted issuers.

Q3: How do I get stablecoins?

You can buy them on crypto exchanges, receive them as payments, or convert fiat via wallet apps.

Q4: Do I need a special app to use them?

Yes, a crypto wallet app. Many are beginner-friendly and work like banking apps.

Q5: Can I earn interest on stablecoins?

Yes! Many platforms let you lend or stake stablecoins for passive income.

Q6: Will stablecoins replace traditional money?

Not entirely—but they’ll coexist, especially in global payments and digital finance.

Conclusion: Why Stablecoins Deserve Your Attention

Stablecoins are much more than a buzzword—they’re a solution. A bridge between old-school finance and the new digital frontier. Whether you’re a business owner, a freelancer, or just someone looking to protect their money, stablecoins offer a better, smarter way to handle your finances.

They’re not perfect. But they are powerful.

In a world where money is becoming more digital by the day, stablecoins are here to stay. They’re not just shaking up the system—they’re rebuilding it from the ground up.