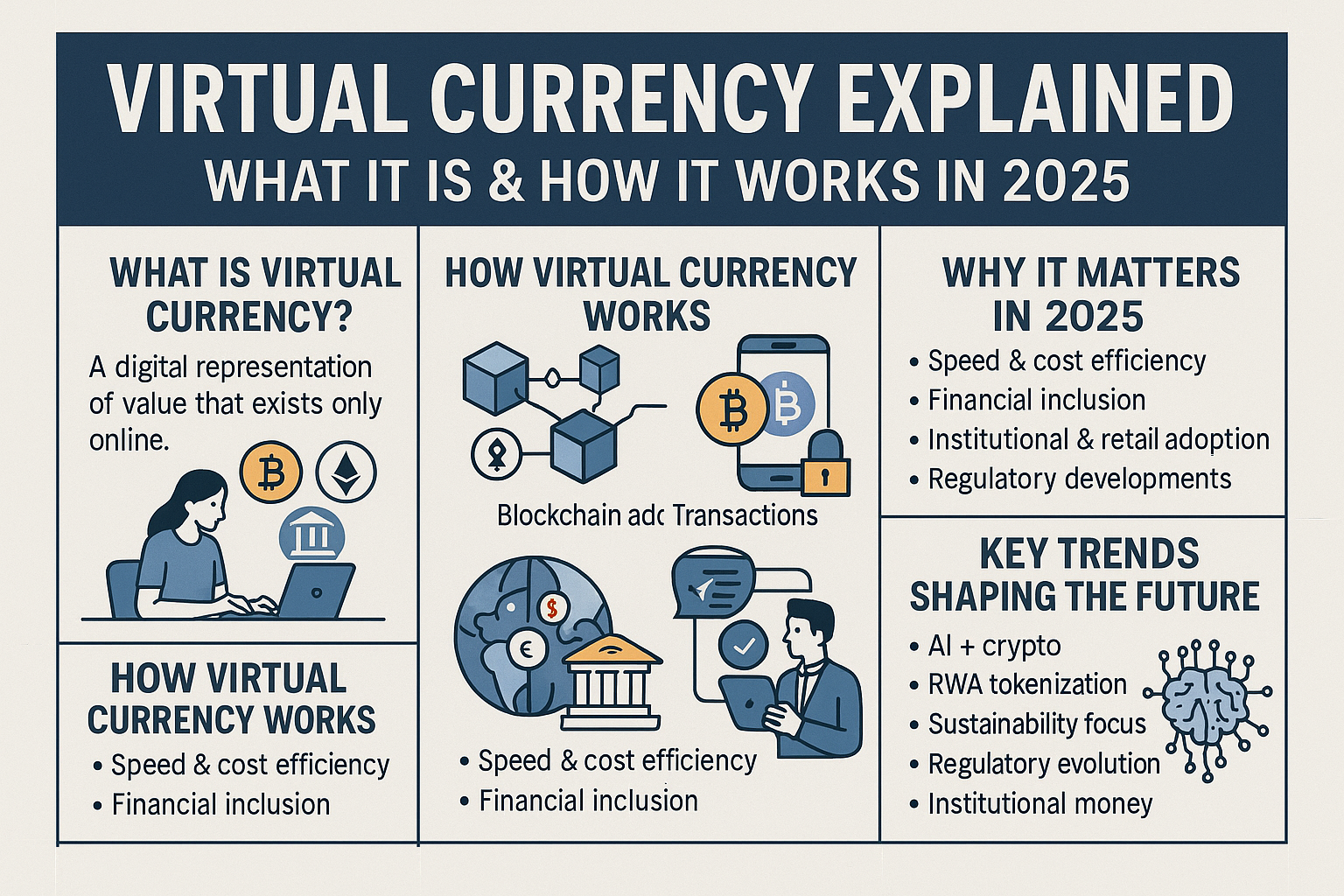

Virtual Currency Explained: What It Is & How It Works in 2025

SEO Title:

Virtual Currency Explained in 2025: The Truth About How It Works & Why It Matters

Meta Description:

Discover what virtual currency truly is, how it works in 2025, and what it means for your money, safety, and future. A real-world, jargon-free guide for beginners and curious minds.

💡 Introduction: Virtual Currency Isn’t Just for Tech Geeks Anymore

Just a few years ago, talking about virtual currency made you sound like a programmer or a Wall Street investor. Fast forward to 2025, and now it’s part of everyday life. Whether you’re buying coffee with Bitcoin, getting paid in USDC, or just watching governments roll out digital versions of their own currency—virtual money is no longer “futuristic.” It’s here.

But what does that actually mean for people like you and me? How does it work behind the scenes? And most importantly—can you really trust it?

Let’s break it all down, in simple language, step by step.

🧾 What Is Virtual Currency (Really)?

Virtual currency is money—just not in the way your wallet thinks of it.

Instead of being printed on paper or minted in coins, it exists purely in digital form. You can’t touch it, but you can use it. You can send it, receive it, invest it, and even earn interest from it.

What makes it “virtual” is that it’s not physical—it lives on the internet. But don’t let that fool you. Many virtual currencies are built on some of the most secure and transparent technologies we’ve ever created, like blockchain.

There are three main types of virtual currency today:

1. Cryptocurrencies (Like Bitcoin & Ethereum)

These are decentralized, meaning no single company or government controls them. They’re based on public blockchain networks and allow peer-to-peer transactions.

2. Central Bank Digital Currencies (CBDCs)

Issued by governments, these digital forms of money (like the digital euro or India’s e-rupee) are tightly regulated but aim to bring the benefits of crypto into the traditional financial world.

3. Private Virtual Currencies (Like In-Game or Platform Tokens)

Think of loyalty points, gaming coins, or credits inside an app. They’re not always convertible to cash, but they’re valuable in their own spaces.

🔧 How Does Virtual Currency Actually Work in 2025?

To understand this, let’s walk through a real-world example:

Imagine you want to send $50 to a friend in another country. Here’s what that looks like in the world of virtual currency:

You open your crypto wallet.

You choose the currency (say USDC or Bitcoin).

You enter your friend’s wallet address.

Click “Send.”

That’s it.

No bank involved. No waiting days. No foreign exchange fees. The transaction is completed within minutes (or seconds), and both of you can track it in real-time.

Here’s What Makes This Possible:

Blockchain: A digital ledger that records every transaction publicly and securely.

Smart Contracts: Self-executing codes that automate actions like payments, interest, or rewards.

Stablecoins: Virtual currencies tied to real-world assets like the US dollar to reduce volatility.

Wallets: Software (or hardware) that lets you store, send, or receive digital currency.

🌍 Why Virtual Currency Matters More Than Ever in 2025

✅ 1. It’s Cheaper and Faster

Banks charge fees. Crypto usually doesn’t (or charges less). Traditional wire transfers can take days. Blockchain settles in seconds.

🌎 2. It’s Changing the Game for the Unbanked

Over 1.4 billion people around the world still don’t have access to a bank. Virtual currencies are helping people in rural or underserved areas receive payments, earn income, and even save money securely.

💼 3. Businesses Are Catching On

From small cafes to global giants like Tesla and PayPal, businesses now accept crypto. Major institutions have also invested billions in digital assets.

📜 4. Governments Are Getting Involved

CBDCs are already in pilot programs in over 130 countries. They’re aiming to modernize monetary systems, make transactions traceable, and reduce fraud.

📈 What’s New in 2025? Key Trends to Know

🔗 AI + Crypto Integration

AI-powered trading bots, smart contract automation, and AI-curated crypto portfolios are making investing easier and smarter.

🏠 Real-World Asset Tokenization

Want to buy a fraction of a house or a Picasso? Tokenization lets you invest in real assets using digital tokens.

🌱 Eco-Friendly Innovation

Thanks to the shift to “Proof-of-Stake” systems, most new blockchains are now energy-efficient and environmentally sustainable.

👮 Stricter (But Smarter) Regulations

Global watchdogs are rolling out clearer guidelines, protecting investors while allowing innovation.

❓ Frequently Asked Questions

Q1: Is virtual currency safe to use?

Yes—if you use secure wallets and follow best practices (like avoiding scams). Most fraud comes from user error, not the currency itself.

Q2: Will digital currencies replace cash completely?

Not entirely, at least not soon. But they’re becoming a powerful alternative, especially in countries pushing for a cashless economy.

Q3: Can I use virtual currency to buy everyday things?

Absolutely. In 2025, more cafes, online stores, travel agencies, and service providers accept crypto than ever before.

Q4: What happens if I lose my digital wallet?

If you lose your wallet and didn’t back it up, you lose access. That’s why secure storage and backups are critical.

Q5: Is this just a fad?

Nope. With trillions of dollars in crypto assets and over 100+ government-backed digital currency pilots worldwide, virtual currency is here to stay.

Q6: How do I get started safely?

Start small. Use well-known platforms like Coinbase, Binance, or trusted wallets. Learn, test with small amounts, and grow as you understand.

🔚 Final Thoughts: Embracing the New Normal

Virtual currency in 2025 is not just about Bitcoin anymore. It’s about access, efficiency, transparency, and control. Whether you’re curious about investing, planning to use digital currency for business, or just want to keep up with the times—it’s worth understanding this shift.

Money is becoming smarter. And the more you understand it, the more empowered you’ll be.