The cryptocurrency landscape is constantly evolving, with innovations reshaping how we think about digital assets and blockchain technology. As we approach 2025, several groundbreaking trends are emerging that could fundamentally transform the crypto ecosystem. Whether you’re a seasoned investor or crypto enthusiast, understanding these developments will be crucial for navigating the opportunities and challenges ahead. In this comprehensive guide, we’ll explore the most significant cryptocurrency trends poised to dominate in 2025, from AI-powered tokens to DeFi innovations and institutional adoption.

1. AI-Driven Cryptocurrency Tokens: The Next Frontier

AI and blockchain convergence is creating new opportunities in the crypto market

Artificial intelligence is no longer just a buzzword in the cryptocurrency space—it’s becoming a fundamental driver of innovation. In 2025, we’re seeing AI-powered tokens emerge as one of the most compelling cryptocurrency trends, creating entirely new use cases and value propositions.

How AI Is Transforming Blockchain Technology

The integration of AI with blockchain is creating tokens that can adapt, learn, and optimize themselves based on market conditions and user behavior. Projects like SingularityNET, Fetch.ai, and Ocean Protocol are leading this revolution by developing decentralized AI marketplaces and services that operate on blockchain infrastructure.

These platforms allow developers to create applications that leverage both the transparency of blockchain and the predictive capabilities of AI. The result is a new generation of crypto assets that can perform complex tasks autonomously, from optimizing DeFi yields to managing decentralized data marketplaces.

“The convergence of AI and blockchain represents the next evolutionary step for cryptocurrency. By 2025, we’ll see tokens that not only store value but actively work to increase it through intelligent algorithms and predictive analytics.”

Key AI Token Projects to Watch in 2025

Predictive Market Tokens

These tokens utilize machine learning to analyze market trends and predict price movements with increasing accuracy. They’re becoming essential tools for traders looking to navigate the volatility of crypto markets.

AI Governance Tokens

These tokens give holders voting rights in decentralized AI networks, allowing community governance of sophisticated algorithms that manage everything from content moderation to resource allocation.

The real-world applications are already emerging. For instance, some DeFi platforms are implementing AI to detect and prevent fraud, while others use it to optimize lending rates based on risk assessment algorithms. As these technologies mature, we’ll see AI tokens become increasingly integrated into mainstream financial services.

Stay Ahead of AI Crypto Innovations

Get our weekly newsletter with the latest insights on AI-powered cryptocurrencies and emerging blockchain technologies.

2. DeFi 2.0: Evolution of Decentralized Finance

The evolving DeFi ecosystem is becoming more interconnected and accessible

Decentralized Finance (DeFi) has been a revolutionary force in the crypto space, and by 2025, we’re witnessing its evolution into what many are calling “DeFi 2.0.” This next generation of decentralized financial services is addressing the limitations of earlier platforms while expanding into new territories.

Cross-Chain Interoperability: Breaking Down Silos

One of the most significant developments in the DeFi space is the advancement of cross-chain technologies. In 2025, protocols like Polkadot, Cosmos, and newer solutions are enabling seamless asset transfers and interactions between previously isolated blockchain networks.

This interoperability is creating a more unified DeFi ecosystem where users can access the best features of different blockchains without the friction of complex bridging mechanisms. The result is greater liquidity, reduced costs, and more innovative financial products.

Institutional DeFi: Bridging Traditional and Decentralized Finance

Institutional adoption is bringing new capital and credibility to DeFi platforms

By 2025, institutional adoption of DeFi has accelerated dramatically. Major financial institutions are not just investing in crypto assets but actively participating in DeFi protocols through specialized platforms that meet their regulatory and security requirements.

This institutional involvement is bringing unprecedented levels of liquidity to DeFi markets while introducing more sophisticated financial instruments. We’re seeing the emergence of compliant lending platforms, institutional-grade yield farming, and decentralized derivatives markets that rival traditional finance in both scale and complexity.

DeFi 2.0 Advantages

- Enhanced security through formal verification and auditing

- Reduced gas fees through layer-2 scaling solutions

- Greater accessibility for non-technical users

- Institutional-grade risk management tools

- Regulatory compliance options for businesses

Challenges to Address

- Regulatory uncertainty in many jurisdictions

- Smart contract vulnerabilities still exist

- User experience needs further improvement

- Centralization risks in some protocols

- Market volatility impacts stability

Real-World Asset Tokenization

Perhaps the most transformative trend within DeFi 2.0 is the tokenization of real-world assets (RWAs). By 2025, we’re seeing everything from real estate and commodities to intellectual property rights being represented as tokens on blockchain networks.

This development is unlocking trillions of dollars in previously illiquid assets, making them accessible for trading, fractionalization, and use as collateral in DeFi protocols. The implications for global finance are profound, potentially democratizing access to investment opportunities that were once reserved for institutional players.

Master DeFi Investment Strategies

Join our community of DeFi investors and get exclusive insights on emerging protocols and yield optimization techniques.

3. Institutional Cryptocurrency Adoption Reaches New Heights

Major financial institutions are increasingly integrating cryptocurrency into their offerings

The institutional adoption of cryptocurrency has accelerated dramatically by 2025, marking a significant shift from the retail-dominated market of previous years. Major banks, asset managers, and corporations are not just investing in digital assets but integrating them into their core business strategies.

Cryptocurrency as a Treasury Asset

Following the pioneering moves by companies like MicroStrategy and Tesla in the early 2020s, by 2025, holding Bitcoin and other digital assets as treasury reserves has become a common corporate strategy. This approach is particularly prevalent among technology companies and forward-thinking corporations looking to hedge against inflation and currency devaluation.

The normalization of crypto as a treasury asset has created sustained demand from institutional buyers, contributing to price stability and market maturation. Corporate balance sheets now routinely include allocations to digital assets, with specialized management strategies developed to handle the unique characteristics of these holdings.

Regulated Crypto Investment Products

| Investment Vehicle | Target Market | Key Benefits | Adoption Level (2025) |

| Crypto ETFs | Retail and institutional investors | Familiar structure, regulatory oversight | Widespread |

| Tokenized Securities | Institutional investors | Fractional ownership, 24/7 trading | Growing rapidly |

| Crypto Yield Products | Wealth management clients | Passive income, portfolio diversification | Mainstream |

| Crypto Derivatives | Sophisticated traders | Hedging, leverage, risk management | Established |

The proliferation of regulated investment products has made cryptocurrency exposure accessible to a much broader range of investors. Exchange-traded funds (ETFs), mutual funds, and structured products now offer varying levels of crypto exposure through familiar, regulated channels.

This institutional framework has helped address many of the concerns that previously kept conservative investors away from the crypto market, including custody solutions, insurance coverage, and regulatory compliance. The result is a more stable, liquid market with reduced volatility compared to earlier years.

“By 2025, cryptocurrency has transitioned from an alternative asset class to an essential component of a diversified investment portfolio. The question is no longer whether institutions should have exposure, but how much and through which vehicles.”

4. CBDCs and Stablecoins: The New Digital Currency Landscape

CBDCs and stablecoins are reshaping the digital currency landscape

The digital currency landscape in 2025 is characterized by the coexistence of Central Bank Digital Currencies (CBDCs) and private stablecoins, each serving different needs in the evolving financial ecosystem. This dual development represents one of the most significant cryptocurrency trends with far-reaching implications for global finance.

The Rise of Central Bank Digital Currencies

By 2025, several major economies have launched their own CBDCs, with China’s digital yuan leading the way in adoption and functionality. These government-backed digital currencies combine the efficiency of blockchain technology with the stability and trust of traditional fiat currencies.

CBDCs are primarily focused on domestic payments, government disbursements, and providing financial services to unbanked populations. They offer unprecedented levels of transaction data for central banks while potentially reducing the costs associated with cash management and distribution.

CBDC Features

- Government-backed and regulated

- Centralized control and oversight

- Integration with existing banking systems

- Programmable money capabilities

- Potential for offline transactions

Stablecoin Advantages

- Global accessibility without borders

- Integration with DeFi ecosystems

- 24/7 operation without banking hours

- Varying degrees of decentralization

- Multiple collateralization models

Stablecoins: The Bridge Between Traditional and Decentralized Finance

While CBDCs focus on government-controlled digital money, stablecoins have evolved to serve as critical infrastructure for the broader cryptocurrency ecosystem. In 2025, regulated stablecoins issued by trusted financial institutions coexist with algorithmic and crypto-collateralized alternatives.

These stablecoins facilitate global remittances, provide on/off ramps for DeFi applications, and serve as a hedge against the volatility of other cryptocurrencies. Their integration with traditional payment networks has made them increasingly useful for everyday transactions, particularly in cross-border scenarios.

Global stablecoin adoption varies by region, with emerging markets showing particularly strong growth

The regulatory landscape for stablecoins has matured significantly by 2025, with clear frameworks established in most major jurisdictions. This regulatory clarity has encouraged traditional financial institutions to issue their own stablecoins or partner with existing providers, further blurring the lines between traditional and crypto finance.

Navigate the Digital Currency Revolution

Get our comprehensive guide to CBDCs, stablecoins, and their impact on the future of money.

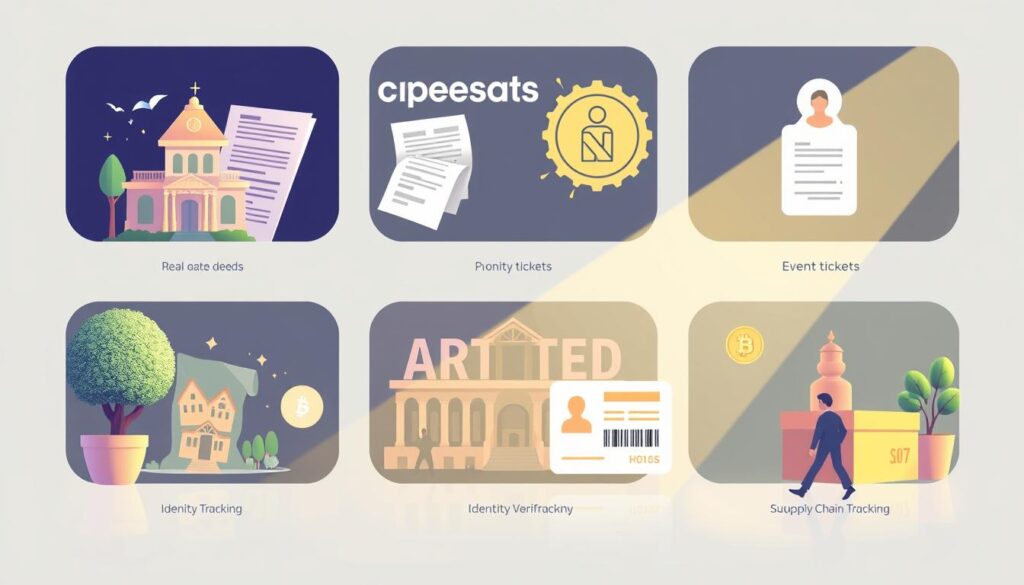

5. NFT Utility: Beyond Digital Art

NFTs are evolving from collectibles to utility-focused applications across industries

Non-fungible tokens (NFTs) have undergone a significant transformation by 2025, moving beyond their initial association with digital art and collectibles to become powerful tools for representing ownership, identity, and access rights in the digital world.

Real-World Asset Tokenization via NFTs

One of the most promising developments is the use of NFTs to represent ownership of physical assets. Real estate properties, luxury goods, and even infrastructure investments are being tokenized as NFTs, creating fractional ownership opportunities and more liquid markets for traditionally illiquid assets.

These asset-backed NFTs combine the uniqueness and provenance tracking of non-fungible tokens with the tangible value of real-world items. The result is a new asset class that bridges the physical and digital realms, offering unprecedented opportunities for investment and ownership.

Identity and Access Management

NFTs have emerged as powerful tools for digital identity and access management. By 2025, NFT-based systems are being used for everything from concert tickets and event access to professional credentials and membership programs.

These utility-focused NFTs offer several advantages over traditional systems, including resistance to counterfeiting, programmable features (such as expiration dates or transferability restrictions), and the ability to capture value from secondary markets.

Gaming & Metaverse

NFTs represent in-game assets, virtual land, and character identities that can move between different gaming environments and metaverse platforms.

Intellectual Property

Music rights, patent licenses, and content distribution are being managed through NFT systems that automate royalty payments and usage tracking.

Supply Chain

Product authenticity, ownership history, and ethical sourcing are verified through NFTs that travel with physical products throughout their lifecycle.

The evolution of NFTs into utility-focused applications has addressed many of the criticisms faced by the first generation of NFT projects. By creating tangible value beyond speculation, these new NFT use cases are gaining acceptance from mainstream businesses and consumers alike.

“The true potential of NFTs was never about selling digital pictures for millions of dollars. It was about creating a new infrastructure for digital ownership that could transform how we interact with both digital and physical assets.”

6. Sustainable Cryptocurrency: Green Blockchain Solutions

Renewable energy sources are increasingly powering cryptocurrency networks

Environmental concerns about cryptocurrency’s energy consumption have driven significant innovations in sustainable blockchain technology. By 2025, the industry has made remarkable progress in reducing its carbon footprint while maintaining security and decentralization.

Proof-of-Stake Dominance

The shift from energy-intensive Proof-of-Work (PoW) to more efficient Proof-of-Stake (PoS) consensus mechanisms has been one of the most significant developments. Following Ethereum’s successful transition to PoS, many other networks have adopted similar approaches, dramatically reducing the energy requirements of blockchain validation.

These PoS networks achieve comparable security with a fraction of the environmental impact, addressing one of the most persistent criticisms of cryptocurrency technology. The result is a more sustainable ecosystem that can scale without proportional increases in energy consumption.

Carbon-Neutral Mining Operations

For networks that continue to use Proof-of-Work, such as Bitcoin, there has been a dramatic shift toward renewable energy sources. By 2025, over 60% of Bitcoin mining is powered by renewable energy, with many operations strategically located near hydroelectric, solar, or wind power facilities.

Some mining companies have gone further by implementing carbon offset programs and investing in environmental projects to achieve carbon neutrality. These initiatives are helping to transform the narrative around cryptocurrency mining from an environmental liability to a potential driver of renewable energy adoption.

Eco-Friendly Cryptocurrencies

A new category of explicitly eco-friendly cryptocurrencies has emerged, designed from the ground up with sustainability as a core principle. These projects often incorporate carbon credits, environmental impact tracking, and governance mechanisms that prioritize ecological considerations.

Some of these tokens are directly linked to environmental initiatives, such as reforestation projects or renewable energy development. By creating financial incentives for ecological conservation, they’re demonstrating how blockchain technology can be part of the solution to climate challenges rather than contributing to the problem.

7. The Evolving Regulatory Landscape

Regulatory clarity is emerging across global markets, creating a more stable environment for crypto innovation

The regulatory environment for cryptocurrency has matured significantly by 2025, moving from the uncertainty of previous years to a more structured framework that provides clarity for businesses and investors. This evolution represents a critical factor in the mainstream adoption of digital assets.

Regulatory Clarity and Compliance

Major jurisdictions have established comprehensive regulatory frameworks that address key aspects of cryptocurrency operations, including licensing requirements, consumer protection measures, and anti-money laundering protocols. This clarity has reduced legal risks for businesses operating in the space and provided confidence for institutional participants.

Compliance solutions have evolved in parallel, with sophisticated tools for transaction monitoring, identity verification, and regulatory reporting becoming standard across the industry. These developments have helped legitimate cryptocurrency businesses distinguish themselves from bad actors and build trust with regulators and the public.

Global Coordination and Standards

International coordination on cryptocurrency regulation has improved dramatically, with organizations like the Financial Action Task Force (FATF) and the International Organization of Securities Commissions (IOSCO) developing global standards for digital asset oversight.

While regulatory approaches still vary between jurisdictions, there is greater alignment on fundamental principles and increased cooperation on enforcement actions. This coordination has reduced regulatory arbitrage opportunities and created a more consistent global environment for cryptocurrency businesses.

Key Regulatory Developments by 2025

- Comprehensive cryptocurrency legislation in the United States, providing clear guidelines for token classification and exchange operations

- Standardized licensing frameworks for crypto businesses across the European Union under MiCA 2.0

- International standards for stablecoin reserves and auditing requirements

- Regulatory sandboxes in multiple jurisdictions to foster controlled innovation

- Specialized courts and dispute resolution mechanisms for blockchain-related cases

The maturation of the regulatory landscape has had a profound impact on the cryptocurrency market, reducing volatility and creating conditions for sustainable growth. While compliance requirements have increased operational costs for businesses, the resulting stability and legitimacy have attracted new participants and expanded the overall ecosystem.

Stay Compliant in a Changing Landscape

Subscribe to our regulatory updates to keep your crypto investments and businesses aligned with the latest requirements.

8. Challenges and Risks in the 2025 Crypto Landscape

Despite progress, significant challenges remain for cryptocurrency adoption and stability

While the cryptocurrency ecosystem has matured significantly by 2025, several important challenges and risks remain that could impact its continued growth and adoption. Understanding these factors is essential for investors and participants in the digital asset space.

Security Vulnerabilities and Exploits

Despite advances in security practices, the cryptocurrency industry continues to face sophisticated attacks and exploits. Smart contract vulnerabilities, bridge hacks, and social engineering attacks remain persistent threats, with hundreds of millions in assets compromised annually.

The increasing complexity of DeFi protocols and cross-chain interactions has created new attack vectors that require constant vigilance and innovation in security measures. While insurance options have expanded, coverage gaps still exist for many types of cryptocurrency assets and activities.

Market Concentration and Centralization Risks

The concentration of mining power, development resources, and token ownership presents ongoing centralization risks to supposedly decentralized networks. By 2025, some projects have seen significant consolidation of control among a small number of entities, potentially undermining their resistance to censorship and manipulation.

This trend toward centralization is particularly concerning for networks that rely on decentralization as a core security feature. Balancing efficiency and decentralization remains one of the most significant challenges facing the industry.

Disclaimer: Investment Risks

Cryptocurrency investments carry significant risks, including but not limited to market volatility, regulatory changes, technical vulnerabilities, and liquidity issues. The information in this article is for educational purposes only and should not be considered financial advice. Always conduct thorough research and consider consulting a financial advisor before making investment decisions.

Scalability and User Experience Challenges

While layer-2 solutions and alternative consensus mechanisms have improved scalability, many blockchain networks still face limitations in transaction throughput and cost efficiency during periods of high demand. These constraints can impact user experience and limit the practical applications of cryptocurrency technology.

Similarly, despite significant improvements in user interfaces and onboarding processes, cryptocurrency applications remain more complex than their traditional counterparts for many users. Simplifying the user experience without compromising security features continues to be a priority for developers across the ecosystem.

How can investors mitigate risks in the cryptocurrency market?

Investors can reduce risks by diversifying across different types of digital assets, using secure storage solutions like hardware wallets, staying informed about regulatory developments, and adopting a long-term perspective that accounts for market volatility. Additionally, using regulated platforms and maintaining proper security practices can help protect against many common threats.

What role will insurance play in the crypto ecosystem by 2025?

By 2025, specialized insurance products for cryptocurrency assets and activities have become more widespread, covering risks like exchange hacks, smart contract failures, and custody issues. These insurance options provide an additional layer of protection for both retail and institutional participants, though coverage limitations and high premiums remain challenges for comprehensive protection.

Conclusion: Navigating the Future of Cryptocurrency

The cryptocurrency landscape of 2025 presents a fascinating blend of innovation, maturation, and ongoing challenges. From AI-powered tokens and evolved DeFi ecosystems to institutional adoption and regulatory clarity, the trends we’ve explored reflect an industry that has moved beyond its experimental phase into a more established position within the global financial system.

For investors and enthusiasts, these developments create both opportunities and responsibilities. The increasing integration of cryptocurrency with traditional finance and real-world applications offers potential for significant value creation, while the persistent risks demand careful consideration and due diligence.

As we look beyond 2025, the boundaries between cryptocurrency and conventional financial systems will likely continue to blur, with blockchain technology becoming an increasingly invisible but essential part of our digital infrastructure. The most successful participants will be those who can adapt to this evolving landscape while maintaining a clear understanding of both the technological fundamentals and the broader economic context.

“The true revolution of cryptocurrency isn’t about replacing traditional finance but transforming it from within—creating a more efficient, accessible, and transparent system that serves a broader range of human needs.”

Whether you’re a seasoned crypto veteran or just beginning to explore this space, staying informed about these trends will be essential for navigating the opportunities and challenges ahead. The cryptocurrency journey continues to evolve, and the chapter being written in 2025 may well be its most significant yet.

Stay Ahead of Cryptocurrency Trends

Join our community of over 50,000 crypto enthusiasts receiving weekly insights, market analysis, and exclusive opportunities.