Introduction

Interest rates are key in the economy, affecting loans, mortgages, and more. Central banks like the Federal Reserve (Fed) and the European Central Bank (ECB) adjust these rates. This change affects financial markets.

If you invest, knowing how rates change impacts assets is vital. We’ll explore how rates affect stocks, bonds, real estate, and savings. This knowledge helps you adjust your portfolio wisely.

How Interest Rates Work

Let’s quickly understand interest rates:

Central Bank Rates: The Fed and other central banks set rates, affecting borrowing costs.

Borrowing & Lending: Higher rates make loans more expensive.

Inflation Control: Central banks raise rates to fight inflation and lower them to boost growth.

Now, let’s see how these changes affect different investments.

1. Stocks & Interest Rates: A Volatile Relationship

How Rising Rates Affect Stocks

When interest rates go up:

✅ Bank Stocks Benefit → Banks earn more from loans.

❌ Growth Stocks Suffer → Tech startups face higher borrowing costs.

❌ Consumer Spending Drops → Expensive loans cut disposable income, hurting retail stocks.

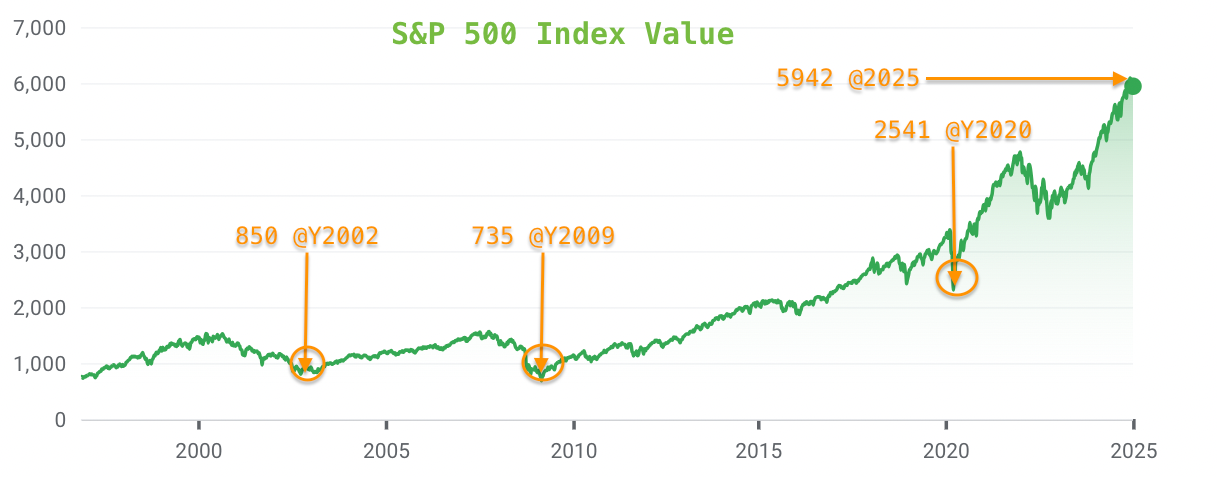

Example: In 2022, the Fed’s rate hikes hurt tech stocks but helped financial ones.

How Falling Rates Affect Stocks

When rates fall:

✅ Growth Stocks Rally → Cheaper borrowing boosts tech and small-cap stocks.

✅ Dividend Stocks Lose Appeal → Investors prefer high-yield stocks over bonds.

❌ Bank Profits Shrink → Lower interest margins hurt financial sector earnings.

Pro Tip: Watch for Fed rate cut hints—these often spark stock market rallies.

2. Bonds & Interest Rates: An Inverse Relationship

Bonds are very sensitive to interest rate changes because of their fixed income.

Impact of Rising Rates on Bonds

🔻 Bond Prices Fall → New bonds with higher yields make existing bonds less attractive.

🔺 Bond Yields Rise → Investors demand higher returns, pushing yields up.

Example: A 1% rate hike can cause long-term bonds to lose 5-10% in value.

Impact of Falling Rates on Bonds

🔺 Bond Prices Rise → Existing bonds with higher yields become more valuable.

🔻 Bond Yields Drop → New bonds offer lower returns.

Strategy:

Short-term bonds are safer during rate hikes.

Long-term bonds gain more when rates fall.

3. Real Estate: Mortgage Rates Decide the Market

Rising Rates = Cooling Housing Market

📉 Higher Mortgage Costs → Fewer buyers, slower price growth.

📉 REITs Under Pressure → Higher borrowing costs reduce profits.

Falling Rates = Real Estate Boom

📈 Cheaper Mortgages → More buyers, rising home prices.

📈 REITs Thrive → Lower debt costs boost profitability.

Case Study: The 2020 rate cuts led to a historic housing boom, while 2022-23 hikes slowed sales.

4. Savings & CDs: Earn More (or Less) on Cash

Rising Rates = Better Returns

💰 High-Yield Savings Accounts offer more interest.

💰 CD Rates Increase → You can earn more by locking in funds.

Falling Rates = Lower Earnings

💸 Savings APY Drops → Your cash earns less interest.

💸 CDs Offer Lower Rates → There’s less reason to lock up your money.

Tip: Use a ladder of CDs to get the most from rising rates.

5. Gold & Commodities: A Hedge Against Rates

Rising Rates → A stronger dollar can make gold less attractive.

Falling Rates → Gold becomes more appealing as a safe investment.

Commodities (Oil, Metals):

Higher rates can slow down industrial demand.

Lower rates might boost the economy, increasing demand for commodities.

How to Adjust Your Portfolio Based on Rate Changes

| Investment | When Rates Rise | When Rates Fall |

|---|---|---|

| Stocks | Shift to value stocks, banks | Buy growth stocks, tech |

| Bonds | Prefer short-term bonds | Favor long-term bonds |

| Real Estate | Caution on REITs | Invest in REITs, housing |

| Savings/CDs | Lock in high rates | Move to stocks/bonds |

| Gold | Reduce exposure | Increase allocation |

Final Thoughts

Interest rate changes can greatly affect your investments. Sometimes, they can help, and sometimes they can hurt. By understanding these changes, you can adjust your portfolio to reduce risks and find new opportunities.

Key Takeaways:

✔ Stocks react differently—banks gain, tech may drop in rising rates.

✔ Bonds move inversely to rates—fall when rates rise.

✔ Real estate slows with higher mortgages but thrives in low-rate eras.

✔ Savings accounts benefit from rate hikes but lose appeal when cuts happen.

Stay updated with central bank policies and adjust your strategy as needed. Happy investing!

Did you find this guide helpful? Share your thoughts in the comments!

#Investing #InterestRates #StockMarket #FinanceTips